Over the last 4 years, I tended to save every single paper, homework assignment and notebook I amassed from 2 graduate programs, and sometimes I wondered why I saved all that stuff… But, every now and then, something pops up in the news and I remember “Oh, I wrote about that 3 years ago.” When I look back on my most notable graduate school papers, some of them still hold relevance today even with the fast paced telecommunications industry. The recent White Spaces progress is one such example. In 2008, I was really excited about the White Spaces. In my spectrum policy class at CU that year (taught in part by Dale Hatfield), I wrote a really detailed paper about rural spectrum policy, which was very well received by the distinguished professors. Here’s a quick introduction to how I was thinking about rural spectrum policy in 2008 (back when there were only 3 million iPhones in service):

Spectrum access is increasingly important for rural telecommunications providers as new advanced wireless technologies are developed and become available on the market. Advanced wireless services can help increase connectivity to all Americans, and innovative wireless applications can improve quality of life for people in remote and rural areas. However, rural telecommunications providers must first have reliable means to access spectrum, or the communities that they serve will continue to wait for the deployment of advanced wireless services by spectrum licensees who focus network investments in more populated—and thus profitable—areas. The purpose of this report is to analyze the FCC’s spectrum policies pertaining to rural spectrum access, and to provide recommendations as to how the FCC—and rural providers themselves—may be able to increase access to spectrum in efficient and effective ways. On one hand, the FCC claims that they are trying hard to accommodate rural providers with much needed spectrum access, but on the other hand rural providers and advocacy groups argue that the FCC could do much more in rural providers’ benefit. In the current state of spectrum policy, regulatory barriers are too high for small rural providers to easily gain access to spectrum. Unless important changes are made to the current system, rural providers will continue to go without adequate spectrum access (licensed and unlicensed) which ultimately penalizes millions of Americans who live far outside metropolitan service area boundaries.

– Rural Spectrum Access and Policy Analysis, August 2008

So has rural spectrum demand and policy changed much since 2008? No, not really—small rural providers still do not have easy access to spectrum. The wireless industry certainly has changed, which has put even more pressure on rural wireless carriers to get into the wireless broadband game or risk becoming obsolete. In 2008, I said “there are still considerable gaps where FCC policy falls short and the interests of rural providers and citizens go unattended.” That is certainly as true today as it was 3 years ago, in my opinion. I also said, “Increasing access to spectrum for rural telecom providers who care about offering quality service to all people is indeed the first step to bridging the digital divide and ensuring equal, quality service for all Americans… To remain competitively viable, rural providers must embrace new spectrum-based services, because ‘wireless technology, which poses the greatest peril to independent rural wireline telcos, may also become their salvation,’” Still true today, for sure.

In this project, I proposed 3 recommendations for increasing spectrum access for small rural telecom providers:

- Adopt a “keep what you use” approach (imagine how different AT&T’s footprint would look if that policy was strictly enforced)

- Use the White Spaces for unlicensed spectrum in rural areas

- Use Universal Service Fund subsidies “to pay rural wireline telcos to switch to wireless or other advanced services.” (No comment…)

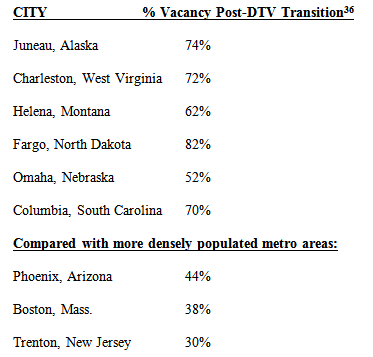

Anyway, at the time, I was really hopeful about the White Spaces: “Since the majority of White Spaces reside in rural areas, using them for unlicensed wireless service may successfully eliminate many of the regulatory barriers preventing rural providers from accessing licensed spectrum. White Space utilization also opens doors for incentives to innovate and deploy services over high-quality frequencies with optimal propagation characteristics for rural areas. Unlicensed wireless service could support interesting applications such as remote crop monitoring and irrigation control; local public safety and municipal networks; and distance education.” I don’t think I will ever forget the following data from a 2008 New America Foundation report, which illustrated how much White Space spectrum was available in certain rural-ish markets:

When the FCC released the White Spaces Order almost exactly one year ago, I was still very hopeful about the possibilities for rural wireless developing in this spectrum… Then I completely forget about it, once the heat turned up on USF Reform. The White Spaces, unused TV frequencies between 50 and 700 MHz, promise specific propagation benefits ideal for rural areas—so much promise that they have been called “Super Wi-Fi.” The FCC’s September 23, 2010 Memorandum Opinion and Order was met with some resistance by country music festivals and sporting event coordinators who claimed White Space devices could interfere with their precious wireless microphones. Thankfully, the FCC did not find that country music festivals were more in the public interest than wireless broadband, but they did require spectrum sensing capabilities in the radios and strict power limitations. Since then, I’ve been waiting for cognitive radio technology and White Space testing to evolve.

It was announced last week that the FCC would finally begin testing the White Spaces database operated by Spectrum Bridge, “which will allow devices to take advantage of the unused spectrum between television channels” (HilliconValley). According to a Sept. 14 FCC press release, “Unlocking this valuable spectrum will open the doors for new industries to arise, create American jobs, and spur new investment and innovation.” Interestingly, Obama also released the American Jobs Act draft legislation this past week, which also includes some hefty aspirations for wireless broadband innovation and deployment resulting from “voluntarily” released broadcaster spectrum. These two actions signal to me that the government s hedging its bets on wireless broadband, which can be seen as either good or bad, depending on what type of company you happen to own. Anyway, the Spectrum Bridge database trial begins tomorrow (Sept. 19) and runs through November 2; after which Spectrum Bridge will provide a report to the Office of Engineering and Technology, which will be followed by a short comment cycle. If everything goes smoothly, “OET would grant final approval for Spectrum Bridge to operate its database system with certified TV band devices once it determines that the system compliant with all of the applicable rules and requirements” (FCC DA 11-1534). Then, hopefully, we will truly be ready to unleash the power of the White Spaces.

What do the White Spaces mean for rural telecom providers? I think it is still too early to tell, but I have definitely been thinking about it for over 3 years now. White Space spectrum is most abundant in rural areas, which is definitely a good thing. It will be unlicensed, and I’m not sure how much success RLECs have had with unlicensed spectrum so far, but this is definitely the right time to start thinking about innovative business models and opportunities to take advantage of this spectrum. One article this week explained, “technology used in these frequencies could go a long way toward helping expand broadband to all Americans, could be used to help corporate networks…to help deliver in-home applications including smart grid, and by wireless and wireline service providers that want to create or fill in existing broadband networks… the prospects of activities related to white spaces to create jobs and continue the wealth of our nation and world are significant” (Paula Bernier, The Dark Cloud Over White Spaces, TMCnet.com).

Two things from this passage stood out to me: the potential for smart grid innovations and for filling in gaps of existing broadband networks. I’m not saying that the White Space spectrum can replace FTTH, but I would bet that it is definitely better than, say, satellite broadband, which some parties in the USF Reform debate are hoping will be used to “fill in the gaps.” I am excited to see technological innovations in cognitive radios and how the White Spaces might help facilitate innovations in wireless technologies for farming, public safety, natural resource management, and industrial/commercial use. How White Space spectrum can be used for normal at-home and at-work broadband remains to be seen. I wouldn’t abandon wired network upgrade plans and put all the eggs in the White Space basket just yet, but I definitely think there will be opportunities for rural carriers in the next couple of years.

It’s nice to see that one of my 2008 rural spectrum policy recommendations is slowly coming to fruition, and I hope that the White Spaces eventually live up to the “Super Wi-Fi” moniker and provide profitable opportunities for small rural telecom providers. Although I love wireless broadband as much as the next analyst, there are specific limitations that have always made me favor FTTH. Specifically, spectrum is a finite resource and glass is not. There is only so much that the FCC can do to increase spectrum access for rural carriers, which is why I have continued to argue that carriers should invest in FTTH even if the demand for 50 Mbps service isn’t widespread today. It will be. In the meantime, all options for expanding broadband in rural areas should be explored to the fullest extent, and that includes unlicensed wireless.

What do you think—are there any opportunities for RLECs in the White Spaces?

Cassandra Heyne